Cheque Requisition

| Submission & Pickup Schedule | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| |||||||||

| Remember, the EUS Office is only open from 8:30-16:30 on Monday-Friday | |||||||||

Cheque Requisition's (Cheque Req's) are the main form of reimbursement for general EUS expenses. Basically, you buy something for your group (it needs to be an approved purchase), and the EUS will pay you back. You can pay in cash, credit, or debit- it doesn't matter, as long as you get a receipt/proof of purchase.

Jump to electronic form.

Contents

The Form

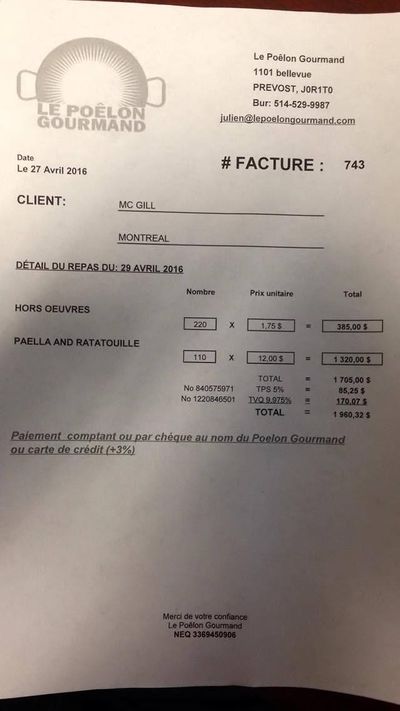

- Note that Quebec receipts may list the French abbreviations:

- GST = TPS and PST = TVQ

- The name indicated in the "Payable to the order of" will be the name printed on the cheque once it's processed.

- When you need a cheque to be made out to a company, this same form will be used.

- When you need a cheque to be made out to a company, this same form will be used.

- The account name and account number can be obtained from the wiki, or the account booklet located in the EUS Office (see diagram below).

- What you write in the "reason for cheque" field will be the description that shows up in the account printout. It should be a brief description of the purchase.

- Please do not write a story why you're making the purchase, just a quick description.

Financial Officers

Anyone can prepare cheque reqs, but they need the signature from one of the approved financial officers of the account. Generally this is the President and VP Finance of the group. This is so that your financial officer can have another layer of control on your group's internal finances.

Mailing

If you need the cheque to be mailed out, please follow the directions outlined on the chequereq form.

Final Steps

After you finish filling it out, staple your receipt/invoices/proof of payment TO THE BACK of the form.

The Administrative Manager of the EUS, who can be found in the EUS Office during the working day, will initial the bottom of your cheque req, and you can then submit it to the box (see right). See the schedule at the top of this page for processing time.

If any step is incorrect, illegible, or lacks documentation, the cheque req will be rejected. Stapling receipts to the front of the cheque req form is grounds for rejection, so make sure everything is neat and organized before submitting. You have been warned.

Other Cases

Online Payment

For all online payment done via card, you must submit:

- Online invoice indicating the name of the payee

- Bank account statement that shows the last 4 digits of your card number and your full name.

These information must be perfect a match with the email/online invoice. The account statement is the ONLY VALID proof of payment for online purchases.

50% Tax Rule

Expenses where a good or service is provided for free (i.e. free food costs), 50% of the tax will be charged. This 50% charge is not applicable when tickets are sold to the event. Indicate on the cheque req if tickets were sold or else your account will get charged the average of the pre- and post-tax amounts.

Out of Province

Transactions made outside of the province can be reimbursed, but you will get charged the post-tax amount. You are only charged pre-tax amounts for purchases made in Quebec. The only exception is when HST or GST are clearly indicated on the receipt for a purchase made in a Canadian province other than Quebec – in this case, the GST or HST will not be charged to you.

Large Expenses

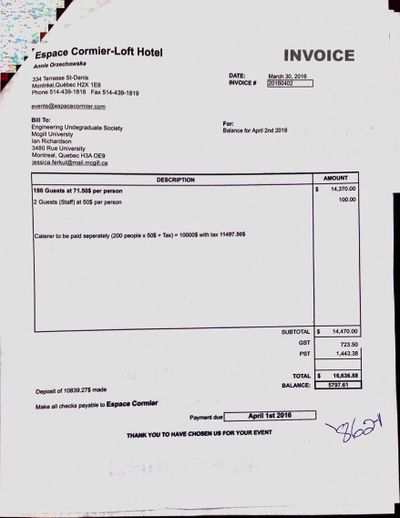

Any expense over $5000 must be personally approved by either the EUS VP Finance or President.

This is because purchases of this amount require someone with EUS signing authority, and these two execs are the only ones with that authority. Simply email them, and ask them to reply back via email with approval.

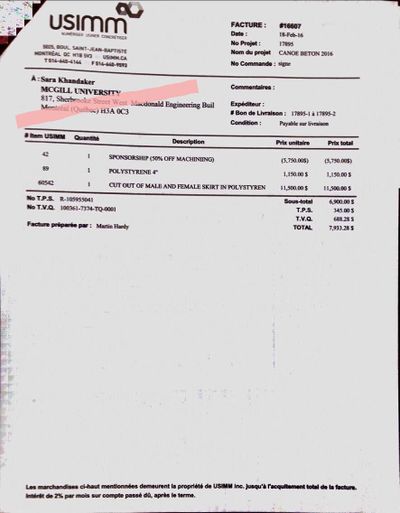

Documentation must be rock-solid. A hand-written receipt for a large purchase probably will not do. The ideal receipt for a large purchase of over $1000 will look like the invoice, except that there will be an indication that it has been paid. Sales tax numbers should be included, as well as the address of the business from whom the purchase is being made.

Foreign Purchases

Foreign purchases are typically made in a foreign currency, but the EUS can only print cheques in Canadian dollars, so an additional step is needed to ensure that you are reimbursed the correct amount. Submit a statement along with the receipt to show the actual conversion and price you were charged. For this reason, you should try to make ALL purchases in the United States or other countries with a Canadian credit or debit card.

Cheque Receipt

Currently, to receive a cheque that has been processed, the person for whom the cheque is written must approach the Administrative Manager in the EUS Office, and they will hand that individual the cheque. Cheques are prepared on Wednesday and should be picked up on the Friday of that week.

Note that it is also possible to have a cheque mailed to you if you will not be in Montreal. Simply indicate this on the cheque req, with the appropriate mailing address.

Invoices

For large expenses or regular expenses, you may prefer for the EUS to pay the vendor directly. To do this, you need them to first send you an invoice. An invoice must have the following:

- Sales tax included and the sales tax numbers.

- The invoice must be addressed to:

- Engineering Undergraduate Society of McGill University

- The address must be:

- 3480 rue University, McConnell Building, Room 7

- Montreal, Quebec, H3A 0E9

Failing to meet the above criteria means that we cannot process the invoice. It is also the responsibility of the Financial Officer of your group to fill out the cheque req and submit it with the appropriate documentation. Submit the invoice at least 10 days in advance of when the money is needed. If your banquet is the next day and you need to get money to pay for it, you might be in trouble. Note that cheques to companies will be mailed unless otherwise indicated.

FOAPAL

McGill entities may request payments through FOAPAL. We cannot pay through FOAPAL, but a McGill group can create an invoice using our FOAPAL information that we will than pay via cheque.

Deposits

For deposits, the EUS will not accept cheque reqs. If you must make a deposit and need it to be paid for, you must submit a proper invoice for the deposit. This policy is in place, because if you make a deposit on a venue and get reimbursed by the EUS, you could hypothetically cancel on the venue and end up with extra money in your pocket.

Electronic Form

If you'd like to fill it out and print the form, you may do so with the following document.

Note: The VP Finance will not accept any electronic submissions for cheqreqs, you must print it out.