Internal records

Internal records are the records that your group keeps of all expenditures and revenues as they are made. The EUS generally does not monitor how you keep your internal records, but it is expected that you do so, because EUS records can be cumbersome to work with, and internal records are the only way you can check the accuracy of EUS records.

Best Practices

Internal records are the only way you can check the accuracy of the EUS records, and they are more easily accessible (the VP Finance must personally prepare a printout for you whenever you want to check on the EUS accounts). You can also put a lot more information into internal records, like breaking them down by event.

- Recommendations

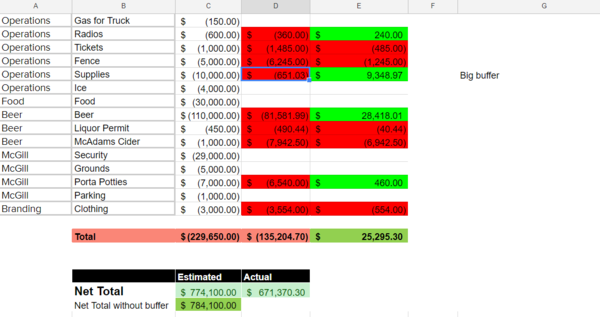

- Every expenditure goes through 2-3 stages.

- An initial prediction of what the price of the expenditure will be.

- The exact value, after it has been paid.

- The value that you have verified has made it into the EUS accounts.

- Your liability account carry over should not be considered as a revenue or expense of your current fiscal year.

- Have all expenses and revenues processed by the financial officer(s)

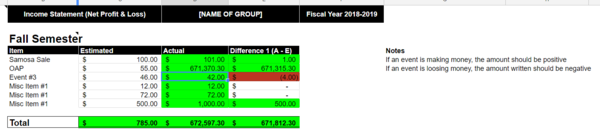

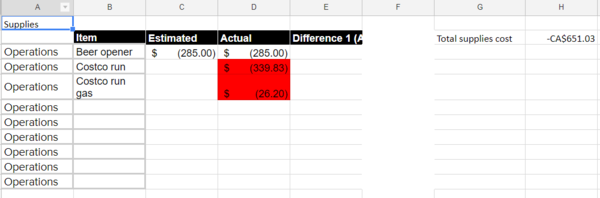

- If you are a department or a large committee, club, or design team, make sure that you show expenditures broken down by event or initiative.

- Don’t lump every transaction your group makes for the entire year into two columns for revenues and expenses.

If you run a ski trip, group the revenues and expenses together, and come up with an overall net loss or profit for the ski trip. Reference this net loss or profit in your overall budget for the year, so that you can see how much you made or lost on individual events and initiatives.

Take a look at the example below: