Internal Transfer

Revision as of 02:32, 16 September 2018 by Malcolmmcc (talk | contribs) (Malcolmmcc moved page Internal Transfers to Internal Transfer)

Try to be tactful with the accounts which you choose to transfer funds from. If you paid for all the food for an event and you want to transfer half the food cost to the group you ran the event with, you should transfer out of your expense account into their expense account. You might have been tempted to mark the transfer of funds in your revenue account, but this would not be accurate – you are reducing an expense, not gaining a revenue, even though both have the same effect.

| “ | Don't make the mistake of transferring to your revenue account when splitting an expense. | ” |

Scenario

- There are some other implications to this rule. Say group A and B run an event, but A handles the money during the event. $2000 in revenue get deposited into Group A’s accounts, and $1000 in expenses get charged against them. You might be tempted to just transfer $500 in profit to Group B from Group A, but the proper thing to do is to transfer $500 in expenses and $1000 in revenues, so that you get the same effect, but things are clearer in the books.

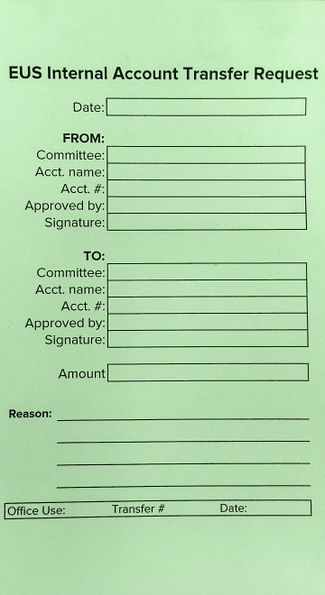

An example of a transfer slip can be seen to the right: