Cheque Requisition

| Submission & Pickup Schedule | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| |||||||||

Cheque Requisition's (ChequeReq's) are the main form of reimbursement for general EUS expenses. Basically, you buy something for your group (it needs to be an approved purchase), and the EUS will pay you back. You can pay in cash, credit, or debit- it doesn't matter, as long as you get a receipt/proof of purchase. Generally speaking, credit or debit is recommended on the off-chance you lose the receipt; there's still a record of the transaction on your bank account.

Contents

The Form

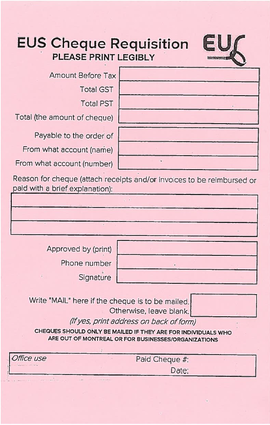

|

The form itself is very self explanatory. You essentially fill in the amounts from your receipt in the first 4 fields. Note Quebec receipts may list the French abbreviations: Provincial: PSTTVQ The name indicated in the "Payable to the order of" will be the name printed on the cheque once it's processed. In most cases, the Cheque Req will be filled out for someone to get reimbursed on a purchase. In other cases, when you need a cheque to be made out to a company, this same form will be used. Financial OfficersAnyone can prepare cheque reqs, but they need the signature from one of the approved financial officers of the account. Generally this is the President and VP Finance of the group. You must let the EUS VP Finance know who your financial officers are if you have not already done so. This is so that your financial officer can have another layer of control on your group's internal finances. Remember, anyone can prepare a cheque req, but you need a verified financial officer to sign it. |

Proper Receipts

A proper receipt shows the pre-tax amount, the provincial sales tax, and the government sales tax. It also shows the TPS (GST) and TPQ (PST) numbers of the business. If any of these elements are missing, the sales tax will be charged to your accounts, and you might not find out until it's too late. Generally speaking, receipts that are provided by a store include all of these elements by default, and you probably don't need to bother checking them.

Pizza places and other small cash businesses commonly give you handwritten receipts without the proper information, but these can still allow you to be reimbursed- just don't expect to get charged the pre-tax amount if you don't have the tax numbers. Likewise, pizza places, cab drivers, and other businesses often will take cash tips, but if you want to be reimbursed for the tip, get them to write the tip on the receipt and sign for it.

Other Cases

50% Tax Rule

Expenses where a good or service is provided for free (i.e. free food costs), 50% of the tax will be charged. This 50% charge is not applicable when tickets are sold to the event. Indicate on the cheque req if tickets were sold or else your account will get charged the average of the pre- and post-tax amounts.

Foreign Purchases

Foreign purchases are typically made in a foreign currency, but the EUS can only print cheques in Canadian dollars, so an additional step is needed to ensure that you are reimbursed the correct amount. Submit a statement (credit statement preferably) along with the receipt to show the actual conversion and price you were charged. For this reason, you should try to make ALL purchases in the United States or other countries with a Canadian credit or debit card.

Cheque Receipt

Currently, to receive a cheque that has been processed, the person for whom the cheque is written must approach Dianne in the EUS Office, and she will hand that individual the cheque. Cheques are prepared on Wednesday and should be picked up on the Friday of that week.

Note that it is also possible to have a cheque mailed to you if you will not be in montreal. Simply indicate this on the cheque req, with the appropriate mailing address.